Weekly Dive for April 7, 2024

Apr 7, 2024

Thinkers are Money Makers

$SPY, $NVDA, $TSLA, $BTC

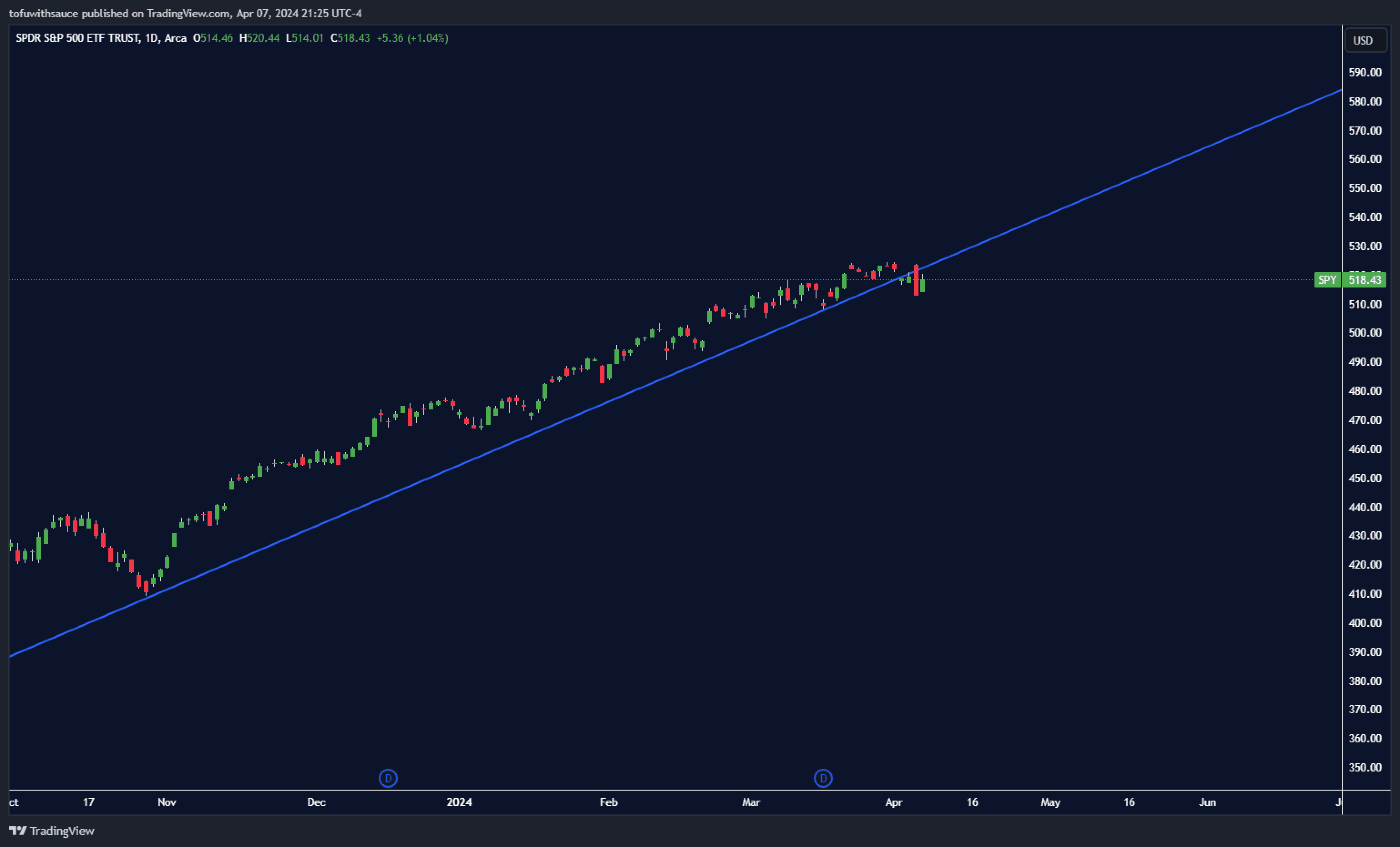

SPY

ETF, comprising 500 stocks, serves as an indicator of the overall stock market performance.

The upward trend has been broken, which could suggest a shift towards more negative conditions. We had anticipated this development might happen sooner rather than later, and it appears we've reached the 'sooner' scenario.

Echoing Warren Buffet, "It ain't over until the fat lady sings." However, it's crucial to understand that the market is impervious to our feelings while our emotions are often self-deceptive.

Instead of relying on hope or guesswork, we should strive to anticipate possible scenarios.

For example, if you're experiencing significant profits from technology stocks, it might be prudent to think about hedging or potentially selling. An alternative hedging method is to invest in inverse stocks, which increase in value when the original stocks decline.

Thinking Inversely

To safeguard your portfolio against declines, consider purchasing inverse stocks. For instance:

These assets rise if the market falls:

SPXU: Bear SPY, 9.31% Dividend

SQQQ: 3x Bear QQQ, 9% Dividend

SDS: 2x Bear SPY, 7% Dividend

SPXS: 3x Bear SPY, 6.21% Dividend

VXX: Tracks volatility, spikes with major news/events.

NVDA

NVDA, a key figure in the tech industry, seems to have reached its cycle's zenith and is exhibiting signs of breaking its upward trend. A decline in NVDA's value might negatively affect many other stocks. This doesn't imply NVDA won't rise again in the present or future, but it currently faces a greater risk of a pullback than previously.

TSLA

Tesla's latest release of Full Self-Driving (FSD) technology across all Tesla models marks a significant milestone, solidifying their position as a pioneer in AI development within the automotive industry. Their groundbreaking advancements have garnered attention from other manufacturers, including giants like GM and Ford, who are now exploring opportunities to license Tesla's technology for integration into their own vehicles.

Moreover, Elon Musk's tweet teasing the revolutionary concept of "robotaxis," set for an official unveiling on 8/8, coupled with the fervent anticipation surrounding the forthcoming Model 2, has not only rattled Reuters but also ignited a meteoric rise in Tesla's stock price, surging to $170 after hours on Friday. With these groundbreaking announcements, analysts foresee an imminent resurgence in Tesla's stock, poised to ascend to the pinnacle of its trajectory.

Bitcoin Halving Approaches

April 20th is fast approaching, and whether we're ready or not, something big is about to happen in the world of Bitcoin mining. The block reward for mining will be slashed from 6.25 to 3.125 BTC per block.

Now, if we take a peek at the historical data, it reveals an interesting pattern: Bitcoin's price tends to climb following these halving events. However, it's not a smooth ride. There are fluctuations between these cycles, with the highest value per coin typically seen 6 to 12 months after each halving.

So, brace yourselves. We're in for a rollercoaster ride, but if history is any indicator, the future could hold some significant gains for Bitcoin enthusiasts.

Although we see the upside of these stocks, it is essential for readers to recognize that investing always carries inherent risks. Therefore, we strongly advise conducting comprehensive market research before committing any capital. Understanding the nuances of the market landscape and considering factors such as financial goals, risk tolerance, and time horizon are paramount in making prudent investment decisions. Consulting with financial professionals or utilizing reputable resources can provide valuable insights and guidance to help navigate the complexities of the investment world effectively.

Thanks and have a good week!

The SharkHedge Team

SharkHedge Founded 2024