Please Wake Up!

Apr 28, 2024

The Sleepiness of Bitcoin: A Week of Anticipation

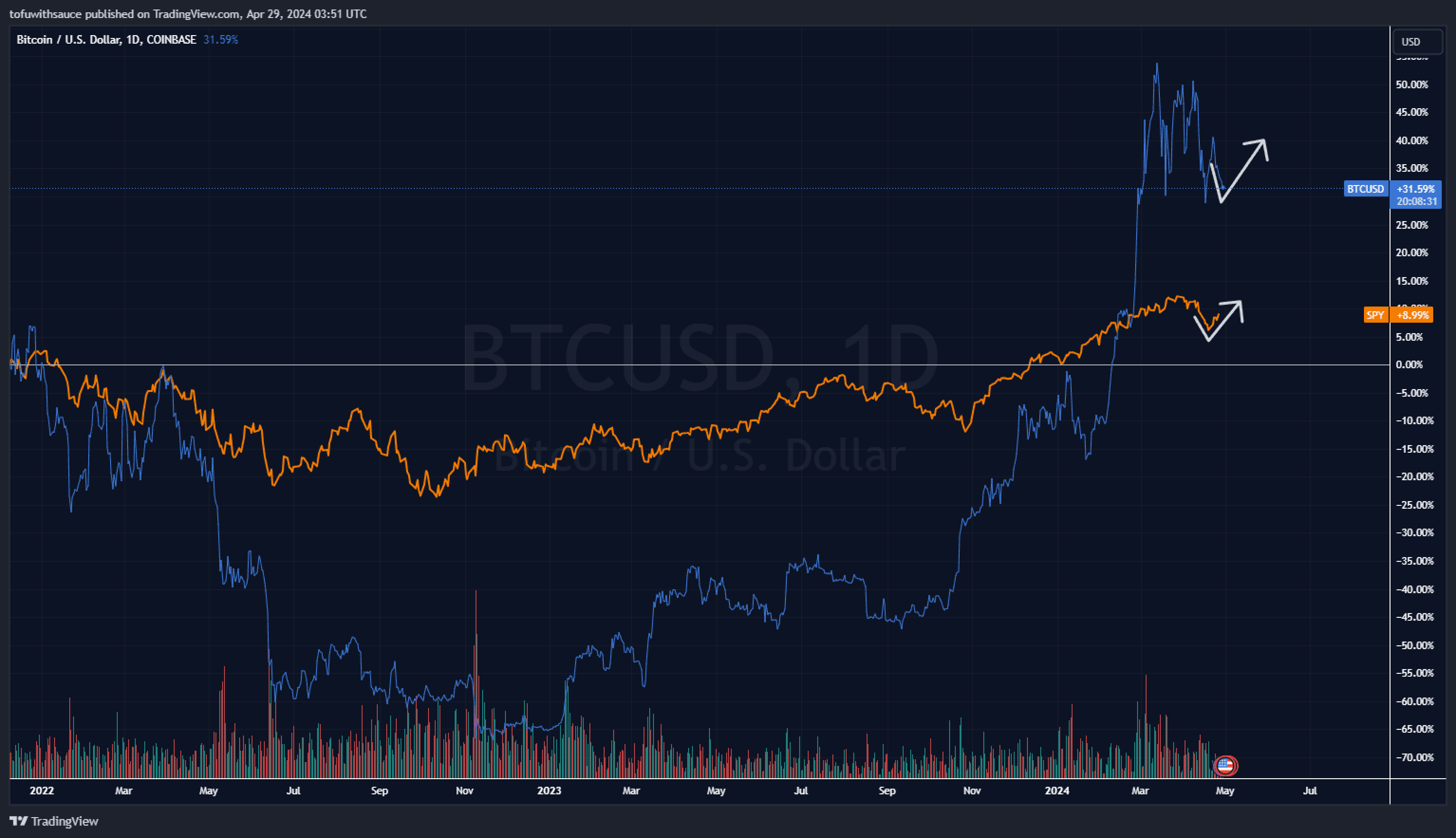

It's been a rather uneventful week in the world of Bitcoin, with the cryptocurrency displaying a surprising level of "sleepiness" in its price action. As we eagerly await the anticipated move up, it's worth reflecting on the factors contributing to this subdued state of affairs.

One significant factor worth considering is the broader market sentiment, particularly the performance of the SPY (Standard & Poor's 500 Index). This week, we witnessed a bounce in the SPY, which mirrored a similar sentiment in the cryptocurrency market. Just as the SPY experienced a bounce week, we can observe a comparable phenomenon in the realm of crypto, albeit with less pronounced movements.

However, despite the lack of excitement on the surface, it's important to remain vigilant and attentive to potential catalysts that could trigger a significant move in Bitcoin's price. Whether it's a surge in institutional interest, regulatory developments, or macroeconomic trends, the cryptocurrency market remains susceptible to sudden shifts and surprises.

As we navigate this period of anticipation, it's crucial to maintain a balanced perspective and avoid succumbing to short-term fluctuations. Instead, let's keep our focus on the bigger picture and the long-term potential of Bitcoin and the broader cryptocurrency ecosystem.

In the meantime, let's stay informed, stay engaged, and stay patient. The next chapter in Bitcoin's journey may be just around the corner, and it's up to us to be prepared for whatever comes our way.

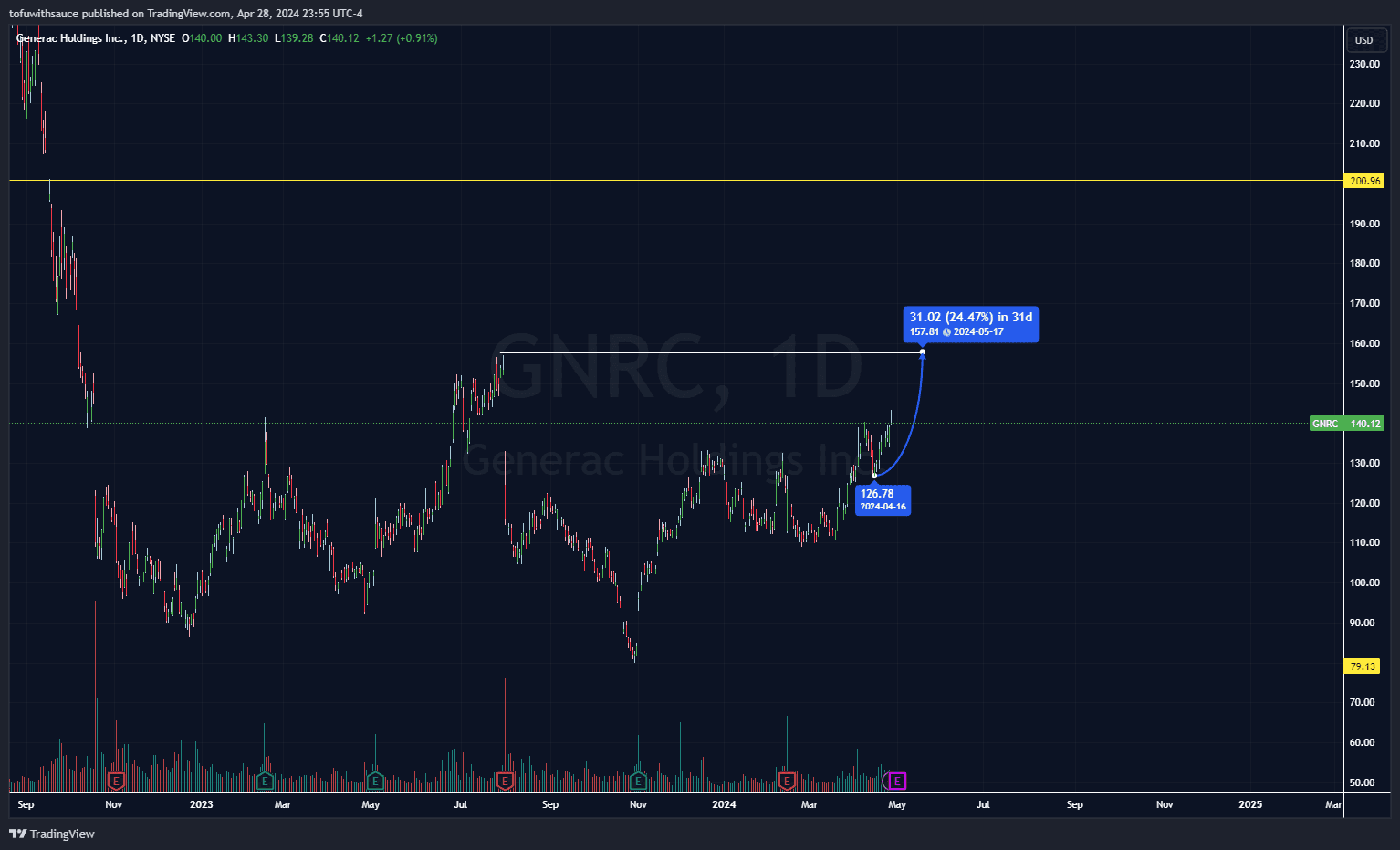

Generac Holdings: Powering Up for Growth Amidst Tornado Season

As tornado season sweeps across parts of the United States, our hearts go out to those affected by the recent tornado in Nebraska. Our thoughts and prayers are with the individuals and communities impacted by this devastating natural disaster.

In times like these, access to reliable power becomes more than just a convenience; it becomes a lifeline for those facing the aftermath of severe weather events. This is where companies like Generac Holdings come into play.

Generac Holdings ($GNRC) is poised for growth, with analysts forecasting a potential uptrend to $150 per share, marking a significant 25% increase in value. However, this trajectory requires a strong performance from the broader market, particularly the SPY (Standard & Poor's 500 Index), to make it a reality.

Generac's innovative backup power solutions position the company as a key player in ensuring continuity and resilience during times of crisis. Their commitment to reliability and innovation makes them a trusted partner for homeowners, businesses, and emergency responders alike.

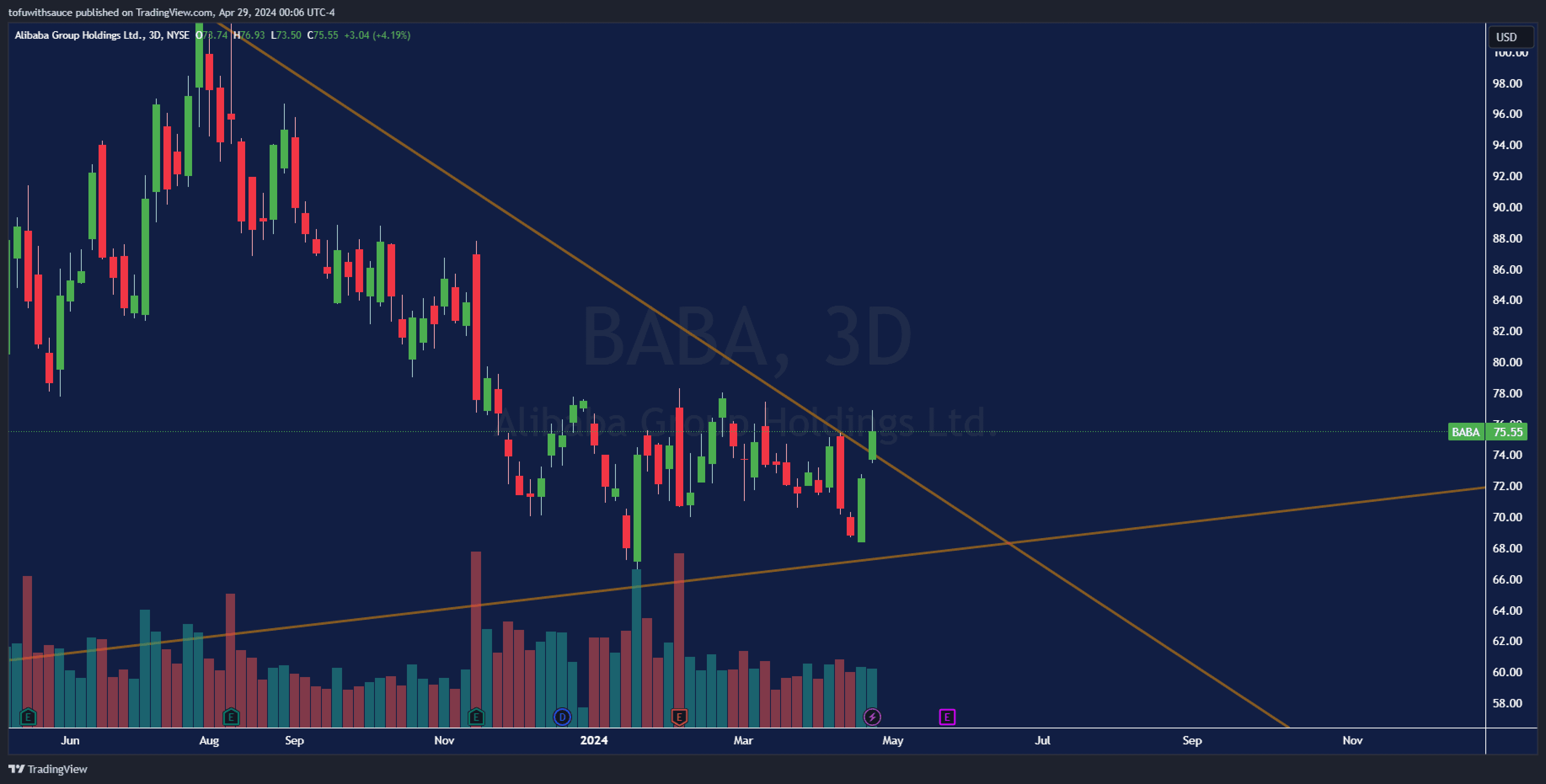

Alibaba ($BABA): Riding the Momentum of a Weekly Wedge Pattern

Alibaba has captured investor attention as it rides the momentum of a weekly wedge chart pattern. This pattern, characterized by converging trend lines over a shorter timeframe, often precedes a significant breakout or breakdown in the direction of the prevailing trend. With Alibaba positioned to break out from this pattern, investors are keenly observing its potential for upward movement.

Crucially, Alibaba's ascent is bolstered by favorable market conditions within the Chinese market. With economic growth, technological innovation, and investor optimism driving momentum, Alibaba stands poised to capitalize on the opportunities presented by this robust market environment.

Moreover, Alibaba's trajectory is intertwined with broader market dynamics, particularly the performance of the SPY (Standard & Poor's 500 Index) and sentiment in global markets. A strong performance from the SPY, coupled with positive developments in the Chinese market, could serve as catalysts for Alibaba's continued upward momentum.

Tesla ($TSLA): Bouncing Back Stronger Than Ever

In recent years, Tesla's visionary leader, Elon Musk, has been vocal about his ambitious vision for the company's future: to transform Tesla from a mere car manufacturer into a pioneering AI robotics powerhouse. This bold shift in focus marks a pivotal moment in Tesla's trajectory, signaling a departure from traditional automotive paradigms towards a future defined by cutting-edge technology and innovation.

At the heart of Elon Musk's vision lies the integration of artificial intelligence (AI) and robotics into Tesla's core operations. Beyond producing electric vehicles, Musk envisions Tesla as a leader in the development and deployment of autonomous systems, encompassing everything from self-driving cars to advanced robotics for a variety of applications.

The rationale behind this transformation is twofold. Firstly, Musk believes that AI and robotics represent the future of technology, with the potential to revolutionize industries and reshape society in profound ways. By positioning Tesla at the forefront of this technological revolution, Musk aims to ensure the company's long-term relevance and success in an increasingly competitive landscape.

Secondly, Musk sees AI and robotics as essential components of Tesla's broader mission to accelerate the world's transition to sustainable energy. By leveraging AI-driven technologies, Tesla can optimize energy efficiency, enhance safety, and streamline operations across its product portfolio, from electric vehicles to renewable energy solutions.

As Tesla continues to push the boundaries of innovation, Elon Musk's vision for the company as an AI robotics powerhouse underscores its commitment to driving progress and shaping the future of transportation, energy, and beyond. While the journey ahead may be fraught with challenges and uncertainties, one thing remains clear: Tesla's evolution from a car company to an AI robotics juggernaut is poised to redefine industries and inspire generations to come.

In Conclusion

s we reflect on the current state of the market, it's evident that the SPY (Standard & Poor's 500 Index) is currently experiencing a bullish movement, buoyed by positive sentiment and strong economic indicators. However, it's essential to maintain a balanced perspective amidst this optimism.

While short-term trends may point towards continued upward momentum, it's crucial to remain mindful of the broader market dynamics at play. With the advent of a new bull market, characterized by rapid gains and heightened volatility, we must exercise caution and prudence in our investment decisions.

Indeed, while the SPY may be riding high in the short term, we anticipate a downward long-term move as we navigate this new phase of market growth. As history has shown, bull markets are often followed by periods of correction and consolidation, presenting both challenges and opportunities for investors.

Therefore, it's imperative to remain vigilant, stay informed, and adopt a diversified approach to investing that accounts for both short-term trends and long-term realities. By navigating the market with patience, discipline, and a strategic mindset, we can position ourselves for success in the ever-changing landscape of finance.

SharkHedge Founded 2024