Happy Halving

Apr 21, 2024

"Lions, Tigers, and Bears: Oh My!

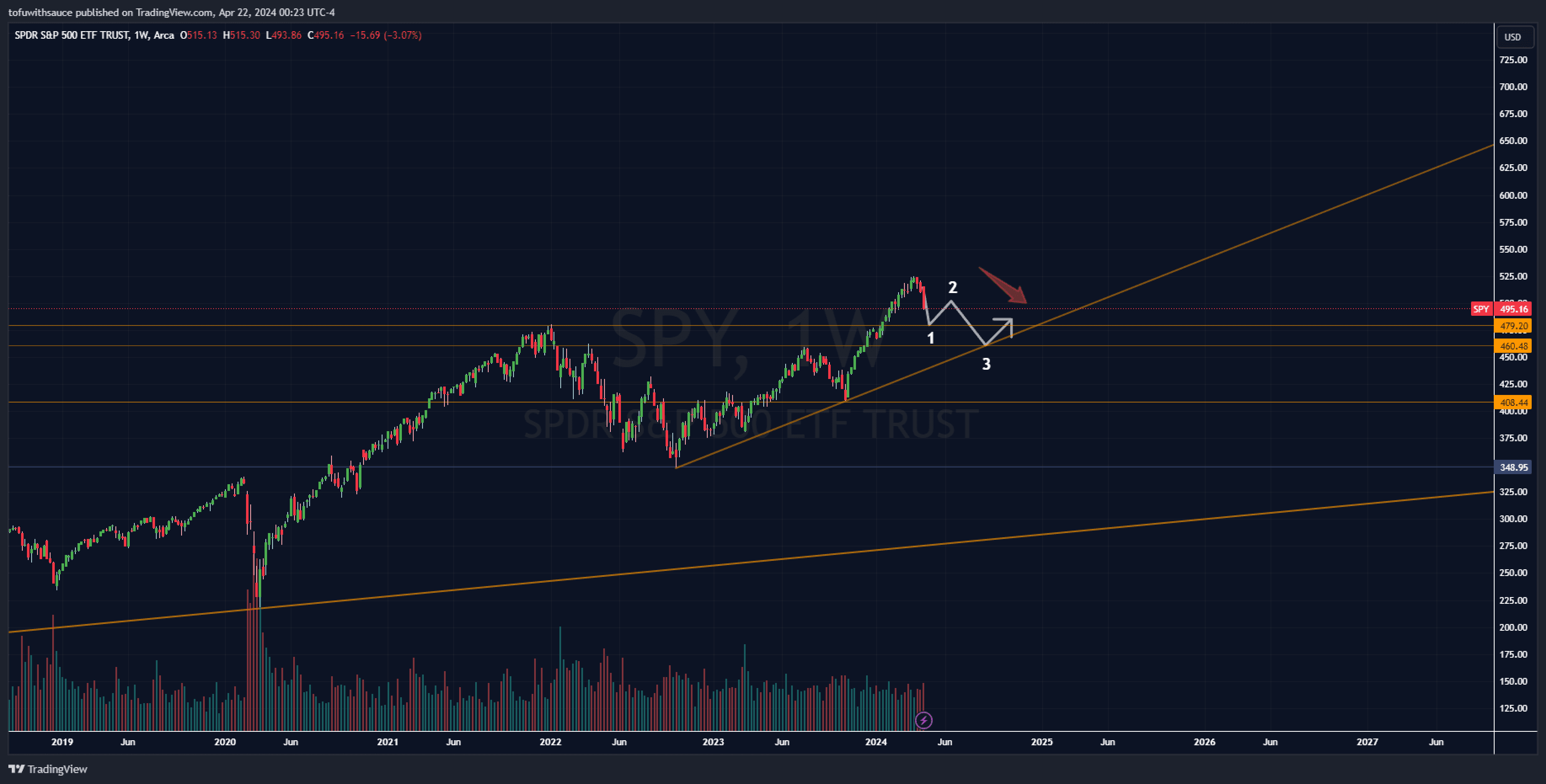

As we stand just a few days post-Bitcoin halving, the cryptocurrency market has already witnessed a promising uptick of 10%. This surge occurs amid broader market movements, including the recent downturn experienced by the SPY (Standard & Poor's 500 Index) over the past couple of weeks. However, historical trends suggest that April typically sees strong performance in both the market and cryptocurrencies, with election years often exerting a positive influence. Yet, amidst this backdrop of optimism, it's important to be mindful of potential short rebounds and to avoid chasing trends, as market dynamics remain uncertain.

April traditionally marks a period of robust performance in both traditional markets and cryptocurrencies, buoyed by historical trends and the positive sentiment often associated with election years. However, it's essential to exercise caution amid market fluctuations. While short rebounds may occur in the near term, chasing these trends can be detrimental to long-term investment strategies. Instead, investors should focus on prudent risk management and remain patient, recognizing that market dynamics can be unpredictable.

Amidst the market's oscillations, monitoring key indicators such as the SPY becomes crucial. When the SPY exhibits a "bearish" trend, it tends to become highly volatile, posing challenges for investors. In such circumstances, proactive measures become imperative. Rolling over hedges, taking profits, and subsequently resetting hedges allow investors to navigate volatility more effectively. By avoiding the temptation to chase short rebounds and maintaining a disciplined approach to investing, investors can mitigate risks and position themselves for long-term success in the face of market uncertainty.

Crazy Rich Asians!

As reiterated on our X page this week, an emerging opportunity unfolds in the Chinese stock market. The FXI, China's largest ETF, has recently shown a double bottom pattern on the weekly chart, indicating a potential upswing in the value of Chinese stocks. Notably, stocks like BABA and ZM, which we've been accumulating through Dollar Cost Averaging (DCA) strategies, stand to benefit from this anticipated resurgence. With this insight, we anticipate a significant uptick in Chinese stocks, underscoring the importance of monitoring these developments closely for potential growth opportunities.

Come With Me If You Want To Live

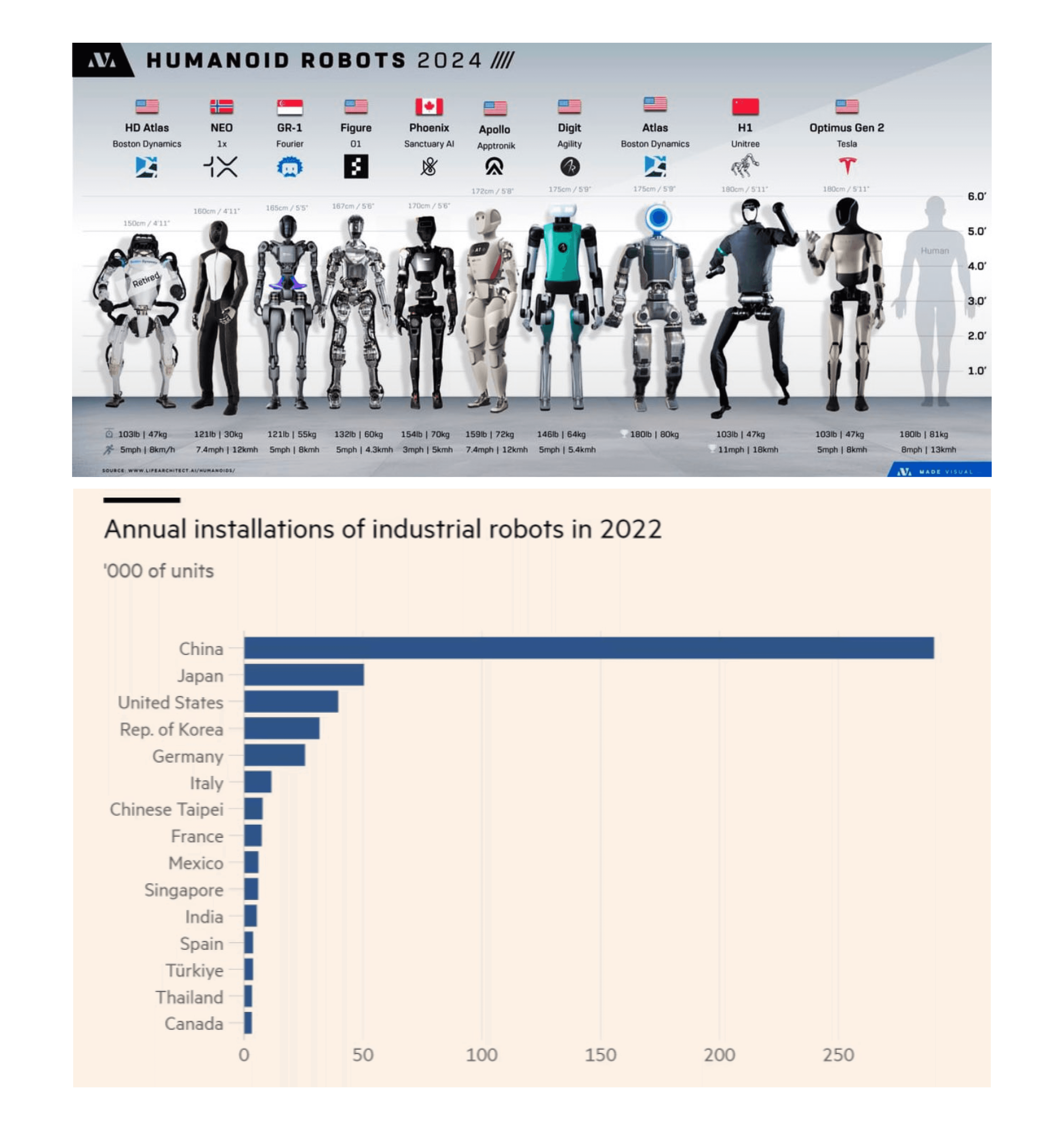

With the rapid advancements in technology, particularly in the realm of robotics, we find ourselves on the brink of a transformative era. The world of robotics has witnessed tremendous growth and development, with significant strides made towards the creation of humanoid robots. These robots, designed to resemble and mimic human movements and capabilities, represent the next evolution in robotics. While the idea of humanoid robots entering the workplace might once have seemed like science fiction, it's now closer to reality than ever before. Indeed, the installation of industrial robots is increasing exponentially, revolutionizing industries and reshaping the way we work. As we stand at the forefront of this technological revolution, the integration of humanoid robots into various sectors holds the promise of increased efficiency, productivity, and innovation, heralding a new era of human-robot collaboration.

In conclusion, we find ourselves amidst a landscape of dynamic change and opportunity across various sectors, from cryptocurrency markets to emerging trends in robotics. As we navigate these complex and interconnected realms, it's essential to remain vigilant and adaptable in our investment strategies. While historical patterns and market insights provide valuable guidance, they should be complemented by individual research and analysis. The recent uptick in Bitcoin post-halving, coupled with the volatility in traditional markets such as SPY, underscores the importance of a diversified approach to investing. Moreover, the emergence of Chinese stocks and the potential integration of humanoid robots into the workplace highlight the transformative power of technological innovation.

As strategists, it's incumbent upon us to stay informed, leveraging insights from diverse sources to make informed decisions. However, it's equally crucial for investors to conduct their own market research, considering their unique financial goals and risk tolerance. By empowering ourselves with knowledge and exercising prudence, we can navigate the complexities of today's investment landscape with confidence and clarity. Ultimately, while the journey may be fraught with uncertainty, it's through strategic planning and informed decision-making that we pave the way for long-term success and prosperity.

SharkHedge Founded 2024